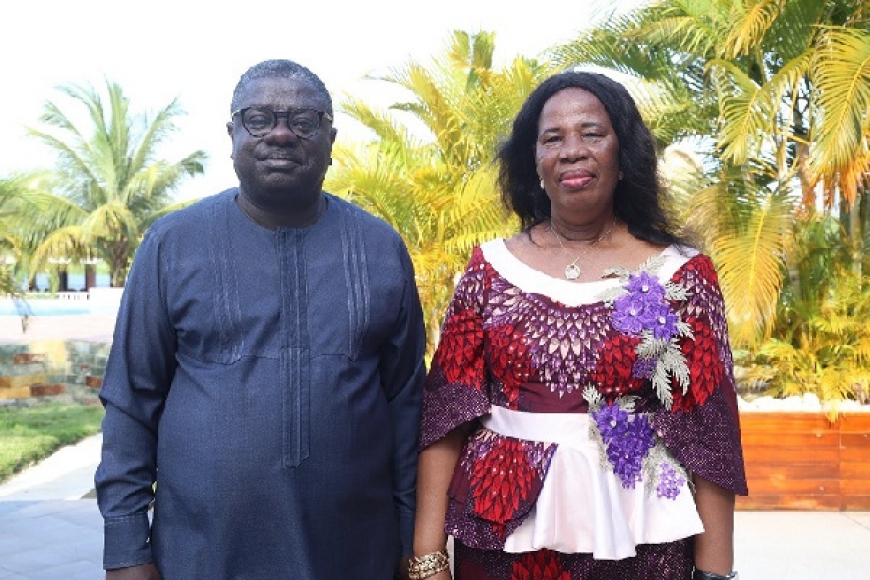

The Ghana Port and Harbours Authority and Trustees for its Pension Fund has bid farewell to Mrs. Mawusi Sapati and Samuel Aning who are retiring from their roles as chairperson and independent Trustee of the Board respectively.

GPHA’S Provident and Pensions Fund was created to guarantee the security of employee earnings after retirement. These two individual had, for 11 years led the Board in protecting the interest of GPHA in the management of the Pension Fund of the staff of the Authority.

According to the well- wishers at the send- 0ff ceremony, the outgoing individuals were consummate professionals who exuded class and integrity in the conduct of their duties.

Samuel Aning, the outgoing Independent Trustee encouraged stakeholders to rely on teamwork in achieving results.

Mawusi Sapati, who doubles as the General Manager, Finance of the Ghana Ports and Harbours Authority expressed satisfaction with how the fund has been managed so far. She said, ‘’the staff should know that the pension fund is their interest. There is therefore the need to uphold it, as it ensures their better tomorrow when they are off routine income’’

Tebon Zumah who takes over from Mawusi Sapati as chairman of the Board ,said he and his team will take off from where his predecessor left off by preserving value.

The board of trustees has a structure which laid down procedures by which we will engage stakeholders .This will come in the form of durbars and even one-on-one discussion with the present administrator and others .We intend to intensify things, especially in this era of misconceptions all over the place ,’’he said.

Afriyie Oware, Co-Founder and Chief Executive Officer of Axis Pension Trust LTD, one of the service providers managing the pension fund, said his outfit will continue to work closely with the board to achieve the objectives of the Authority for the fund. He also assured investors that their monies are safe.

Mr. Oware said,’’ the safeguard around the management is pretty robust and anybody who his\her fund in the pensions scheme can be rest assured that the fund is protected from any form of abuses.’’